How to Successfully Engage in Forex Trading 1606526282

Forex trading, or foreign exchange trading, refers to the global marketplace where currencies are bought and sold. It is one of the most lucrative financial markets in the world, with a daily trading volume that exceeds $6 trillion. If you are intrigued by the prospect of trading currencies, then understanding how to do Forex is essential. In this guide, we will explore the basics, strategies, and tips to help you navigate this exciting market effectively. For a deeper dive into professional trading insights, check how do you do forex trading webglobaltrading.com for more resources.

What is Forex Trading?

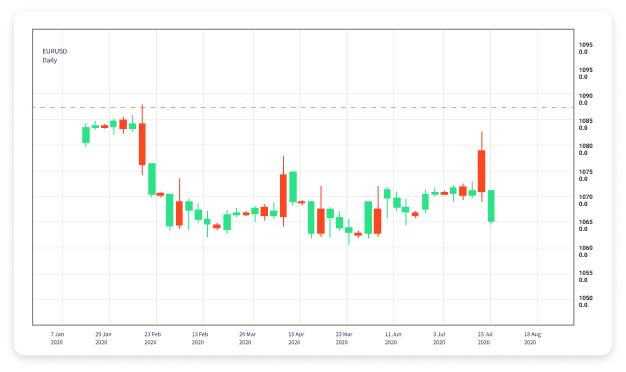

Forex trading involves the exchange of one currency for another at an agreed price, known as the exchange rate. The primary function of Forex trading is to facilitate international trade and investment. As currencies fluctuate due to various factors, traders aim to profit from these changes in value. For example, if you believe that the Euro will strengthen against the US Dollar, you would buy Euros and sell Dollars in anticipation of a profit.

Understanding Forex Market Mechanics

The Forex market operates 24 hours a day, five days a week, making it accessible to traders around the world. It is decentralized, meaning there is no single physical marketplace. Instead, trading occurs over electronic networks and via online platforms. Currency pairs are the foundation of Forex trading, with major pairs including EUR/USD, GBP/USD, and USD/JPY. Each currency pair has a bid price (the price at which you can sell the base currency) and an ask price (the price at which you can buy the base currency).

Key Concepts to Understand

1. Leverage

Leverage allows traders to control larger positions than their initial investment would typically allow by borrowing funds from a broker. For example, with a leverage ratio of 100:1, you can trade $100,000 worth of currency with just $1,000. While leverage can amplify profits, it also increases risk, making it crucial for traders to use it judiciously.

2. Pips

A pip, or “percentage in point,” is the smallest price move that a given exchange rate can make. In most currency pairs, a pip is equivalent to 0.0001. Understanding pips is essential for calculating potential profits and losses.

3. Spread

The spread is the difference between the bid and ask price. Brokers often charge a spread as their fee for facilitating the trade. The size of the spread can impact your trading costs and should be taken into consideration when choosing a broker.

Trading Strategies

Successful Forex trading relies on well-defined strategies. Here are a few popular approaches:

1. Day Trading

Day trading involves executing multiple trades within a single day, taking advantage of short-term price movements. Traders close all positions before the market closes to avoid overnight risk.

2. Swing Trading

Swing traders aim to profit from price swings over a period of days or weeks. This strategy requires a good understanding of market trends and technical indicators.

3. Scalping

Scalping is a high-frequency trading strategy that aims for small, quick profits throughout the day. Scalpers typically hold positions for a few seconds or minutes.

Technical and Fundamental Analysis

To make informed trading decisions, traders utilize both technical and fundamental analysis:

1. Technical Analysis

This approach involves analyzing price charts and chart patterns to forecast future price movements. Traders often use various indicators such as moving averages, Bollinger Bands, and the Relative Strength Index (RSI) to assist their decisions.

2. Fundamental Analysis

Fundamental analysts evaluate economic, political, and social factors that can affect currency values. This includes analyzing economic indicators such as interest rates, GDP growth, employment data, and geopolitical events.

Risk Management

Effective risk management is critical for long-term success in Forex trading. Here are some strategies:

1. Set Stop-Loss Orders

A stop-loss order automatically sells a currency pair when it reaches a specified price, limiting potential losses. Establishing a stop-loss level is a crucial aspect of risk management.

2. Use Position Sizing

Position sizing refers to determining how much capital to allocate to a particular trade based on your total account size and risk tolerance. This helps prevent substantial losses on any single trade.

3. Diversify Your Portfolio

Diversification involves spreading your investments across different currency pairs and other asset classes to reduce risk. By not putting all your capital into one trade, you can minimize the impact of unfavorable market movements.

Choosing a Broker

Selecting the right Forex broker is crucial for your trading experience. Here are some factors to consider:

1. Regulation

Ensure the broker is regulated by a reputable financial authority. Regulation provides a level of protection for your funds and ensures ethical practices.

2. Trading Platform

The trading platform should be user-friendly, stable, and feature-rich. Look for platforms that offer essential tools such as charting, analysis, and automated trading features.

3. Customer Support

Reliable customer support is essential for resolving any issues that may arise. Check for reviews and feedback on the broker’s support services before making a decision.

Continuous Learning and Improvement

The Forex market is constantly evolving, and ongoing education is crucial for staying updated on market trends, strategies, and economic events. Consider joining online trading communities, attending webinars, and reading books to enhance your trading knowledge. Practicing on demo accounts can also help build your skills without risking real capital.

Conclusion

Engaging in Forex trading requires a solid understanding of the market, sound strategies, and effective risk management. By taking the time to educate yourself and practice, you can increase your chances of success in this dynamic field. Remember to always stay disciplined, manage your emotions, and continuously evaluate and adjust your trading strategies as needed. With dedication and perseverance, you can navigate the world of Forex trading with confidence.